Factors Affecting Forex Markets

Forex, or foreign exchange, refers to the market where currencies are traded. The forex market is the largest financial market in the world, with an average daily trading volume of over $5 trillion. The forex market is affected by a multitude of factors, including economic, political, and social events. In this article, we'll explore the various factors that affect the forex market, and how they can impact currency prices.

Economic Factors

Economic factors are perhaps the most significant drivers of currency prices. The performance of a country's economy can have a significant impact on the value of its currency. Economic indicators such as gross domestic product (GDP), inflation, and employment can all affect currency prices.

GDP represents the total value of goods and services produced by a country. A strong GDP indicates a healthy economy, which can lead to an increase in currency value. Conversely, a weak GDP can lead to a decrease in currency value.

Inflation is another important economic indicator. Inflation refers to the rate at which prices for goods and services increase over time. High inflation can lead to a decrease in currency value, as it reduces the purchasing power of that currency.

Employment is also a significant factor in determining the strength of a country's economy. Low unemployment rates can indicate a healthy economy, which can lead to an increase in currency value.

Central Bank Policies

Central banks play a critical role in the forex market. They have the power to influence currency values through their monetary policies. Central banks can adjust interest rates, which can impact currency prices.

When a central bank raises interest rates, it can lead to an increase in the value of that country's currency. This is because higher interest rates can attract foreign investment, which increases demand for that currency.

On the other hand, when a central bank lowers interest rates, it can lead to a decrease in the value of that country's currency. Lower interest rates can make that currency less attractive to foreign investors, which can reduce demand for that currency.

Political Factors

Political events can also have a significant impact on the forex market. Elections, political instability, and policy changes can all affect currency prices.

Elections can be particularly important for currency traders, as the outcome of an election can lead to significant policy changes. For example, if a new government is elected with a more protectionist stance on trade, that could lead to a decrease in the value of that country's currency.

Political instability can also impact currency prices. Uncertainty can make investors nervous, which can lead to a decrease in demand for that currency.

Policy changes can also affect currency prices. For example, if a country implements policies that promote economic growth, that can lead to an increase in currency value. On the other hand, policies that restrict economic activity can lead to a decrease in currency value.

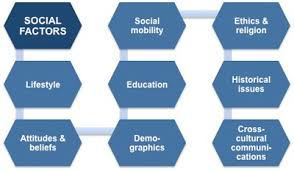

Social Factors

Social factors can also impact the forex market. Demographic changes, cultural shifts, and changes in consumer behavior can all affect currency prices.

Demographic changes, such as changes in population size or age distribution, can impact currency prices. For example, an aging population can lead to lower economic growth, which can lead to a decrease in currency value.

Cultural shifts can also impact currency prices. For example, if a country becomes more environmentally conscious, that could lead to a decrease in demand for fossil fuels, which could lead to a decrease in the value of currencies of countries that rely heavily on the export of fossil fuels.

Changes in consumer behavior can also impact currency prices.

0 Comments

Post a Comment