Types Of Forex Orders

When it comes to trading forex, having a deep understanding of the different types of orders available can help you make informed decisions and navigate the market strategically. In this article, we will explore the various types of forex orders and how they are used.

1. Market Orders

Market orders are the most commonly used orders in forex trading. When you place a market order, it means that the trade will be executed at the current available market price. A market order is typically used when you need to enter or exit the market quickly, and the exact price is not as important as the speed of execution.

For example, let's say you want to buy USD/JPY, and the current market price is 110.50. If you place a market order to buy USD/JPY at this moment, the order will be executed at the current market price of 110.50.

2. Limit Orders

Limit orders allow traders to set a specific price at which they want to enter or exit the market. A limit order is used when you want to buy or sell at a specific price, and you do not want to enter the market until that price is reached.

For example, let's say you want to buy EUR/USD, and the current market price is 1.1500. If you want to buy at a lower price, say 1.1450, you can place a limit order. This means that the order will only be executed if the price of EUR/USD falls to 1.1450.

3. Stop Orders

Stop orders are used to enter a position or exit a position once the market hits a specific price level. A stop order can be used to limit losses or to protect profits.

There are two types of stop orders: stop-loss orders and stop-entry orders.

- Stop-loss orders are used to limit losses. For example, let's say you bought GBP/USD at 1.3000, and you do not want to lose more than 50 pips. You can place a stop-loss order at 1.2950, which means that your position will be automatically closed if the price of GBP/USD falls to 1.2950.

- Stop-entry orders are used to enter the market once a specific price is reached. For example, let's say you want to buy AUD/USD if the price reaches 0.7500. You can place a stop-entry order at 0.7500, which means that your position will be automatically opened if the price of AUD/USD reaches 0.7500.

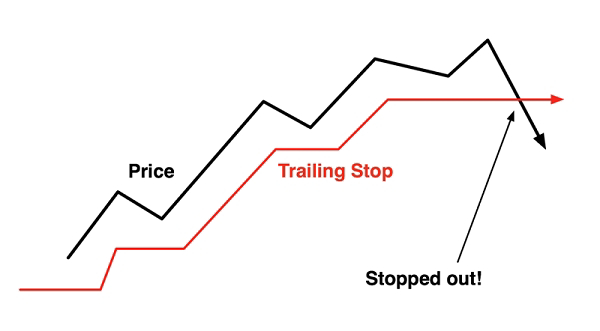

4. Trailing Stop Orders

Trailing stop orders are a type of stop-loss order that is used to protect profits. A trailing stop order is placed at a specific distance from the market price, and it moves with the market price.

For example, let's say you bought USD/JPY at 111.00, and you placed a trailing stop order 50 pips away from the market price. If the price of USD/JPY rises to 111.50, the trailing stop order will move up to 111.00, which means that your position will be protected against any further losses.

5. One Cancels Other (OCO) Orders

OCO orders are used to place two orders at the same time, but only one of them will be executed. This type of order is used when you want to take advantage of different trading opportunities.

For example, let's say you want to buy EUR/USD, but you are not sure at which price level to enter. You can place a buy limit order at 1.1450 and a buy stop order at 1.1550. If the price of EUR/USD falls to 1.1450, the buy limit order will be executed, and the buy stop order will be canceled. If the price of EUR/USD rises to 1.1550, the buy stop order will be executed, and the buy limit order will be canceled.

Conclusion

Understanding the different types of forex orders is an essential part of successful trading. By using the right type of order, you can enter and exit the market at the right time and protect your profits. Knowing when and how to use each type of order can boost your trading strategy and help you achieve your financial goals.

0 Comments

Post a Comment